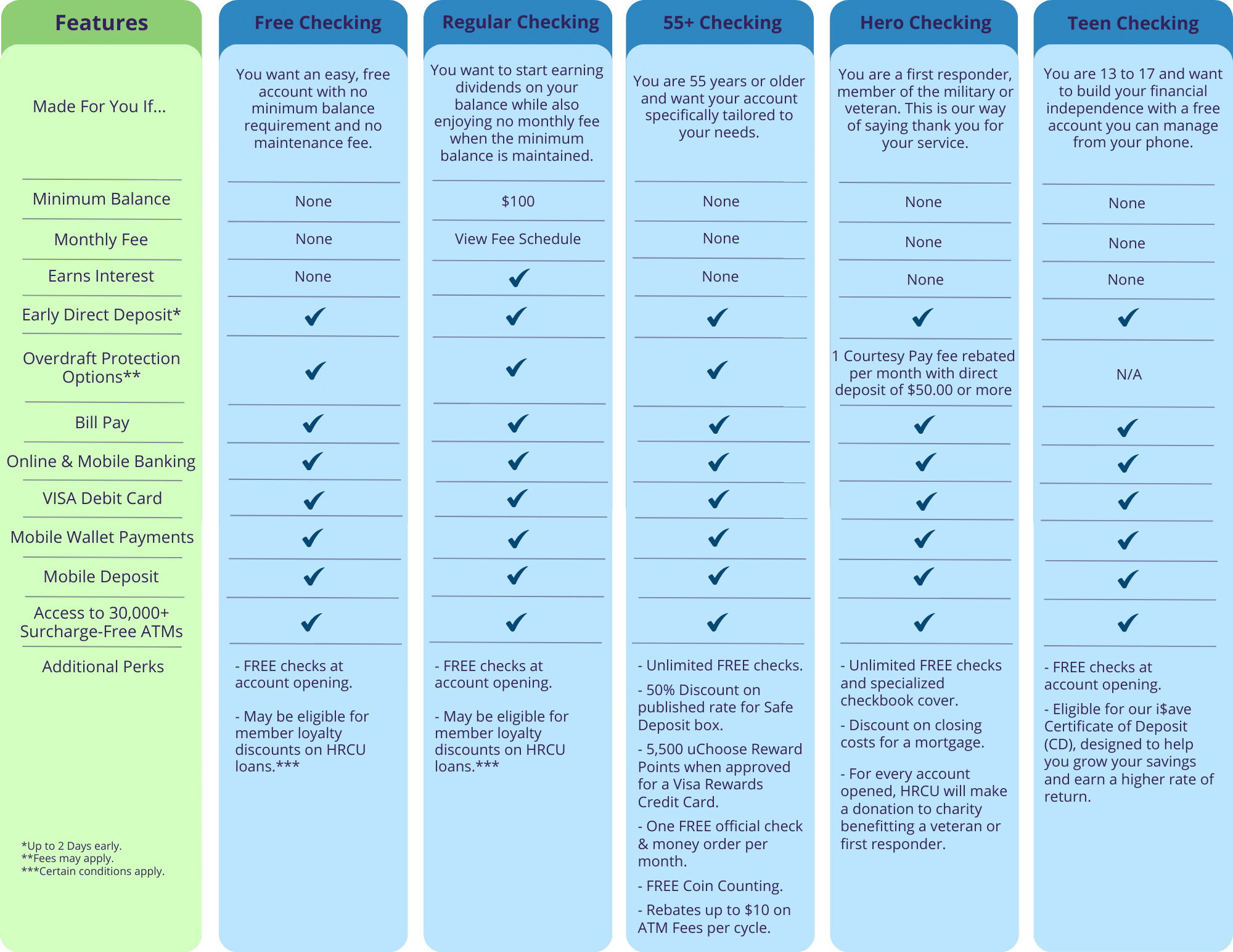

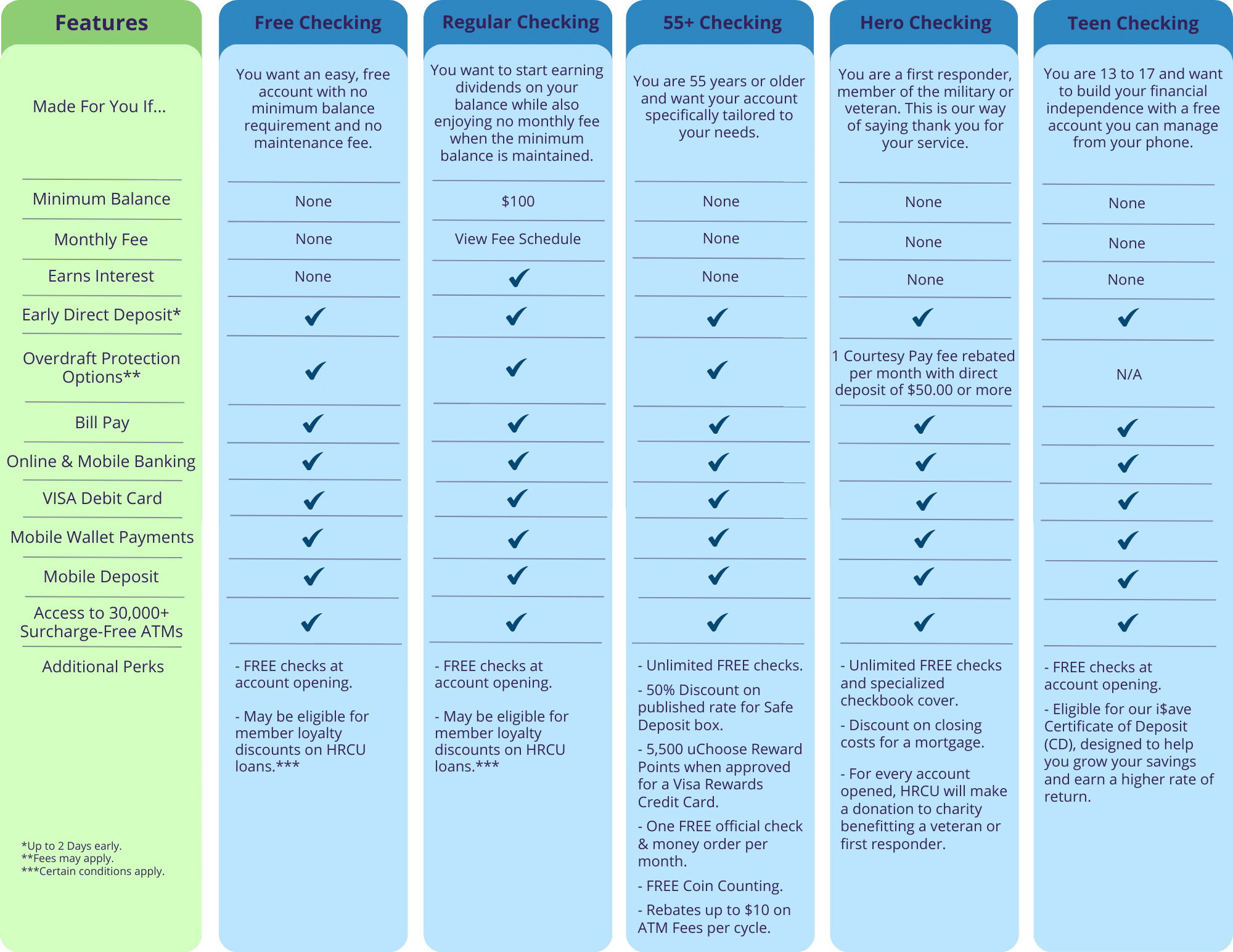

Compare Checking Accounts

Additional Logins:

No minimum balance requirement, no monthly maintenance fee, and unlimited access to your funds - now that's a truly FREE checking account.

Make your money work for you! Take advantage of even more great benefits and services while boosting your balance with competitive monthly dividends.

| Minimum Deposit | Dividend Rate | APY* | Minimum Required to Earn APY |

|---|---|---|---|

| $100 | .05% | .05% | $100 |

*Annual Percentage Yield. All Dividends are based on the Average Daily Balance and are paid monthly. All rates are variable and subject to change without notice. Penalty for early withdrawal applies to Certificates of Deposit. Deposits are fully insured up to $500,000; to at least $250,000 by the NCUA and $250,000 by Excess Share Insurance. IRA deposits are fully insured up to $500,000; $250,000 by the NCUA and $250,000 by Excess Share Insurance.Maintenance or activity fees could reduce the earnings on the account.

For our members 55 and older, we have designed an account with you and your needs in mind.

HRCU values first responders, the military and veterans, that's why we have designed an account tailored to the needs of our Hero Members.

Calling all teens! Are you ready for the next step towards financial independence?

Manage your money with a Teen Checking Account. Shop online, save for something big, or just keep your funds safe and sound. It's all on your terms.

Bring your parent or guardian to one of our branch locations and open a Teen Checking account. Available for members aged 13 to 17.

We are proud to offer you a smart solution for healthcare spending! Interest earned on funds deposited into your Health Savings Checking Account (HSA) can be used to pay for qualified medical expenses tax-free. This account has no opening or monthly fees, and it's a high-yielding interest rate pays at least twice that of other local financial institutions offering HSAs. Available only if you have a high deductible health insurance plan.

Ready to get started on your health savings?

Visit us at any branch location, call Member Support or use the Live Chat function on your screen to get started.

Qualified out-of-pocket medical expenses include:

2024 HSA Annual Contribution Limits:

| Minimum Deposit | Dividend Rate | APY* | Minimum Required to Earn APY | |

|---|---|---|---|---|

| $0 | 0.10% | 0.10% | $5 | Learn More |

| $2,500 | 0.30% | 0.30% | $2,500 | Learn More |

| $10,000 | 0.55% | 0.55% | $10,000 | Learn More |

*Annual Percentage Yield. All Dividends are based on the Average Daily Balance and are paid monthly. All rates are variable and subject to change without notice. Penalty for early withdrawal applies to Certificates of Deposit. Deposits are fully insured up to $500,000; to at least $250,000 by the NCUA and $250,000 by Excess Share Insurance. IRA deposits are fully insured up to $500,000; $250,000 by the NCUA and $250,000 by Excess Share Insurance.Maintenance or activity fees could reduce the earnings on the account.

To be eligible for HSA, owner must have a qualified, high deductible health insurance plan.

Annual contribution limits are determined by the Internal Revenue Service (IRS).

Funds withdrawn for non-qualified expenses will be taxed at your income-tax rate, plus a 20% tax penalty if under the age of 65.

The IRS states that a negative balance in your HSA account is prohibited by federal law. This means that you cannot have any transaction, fee or charge that causes your HSA account to have a negative balance. It is extremely important that you do not overdraw your HSA account.

We encourage you to set up an account balance alert on your HSA account to help effectively manage your account and avoid a negative balance. By opening an HRCU HSA, you agree to immediately deposit sufficient funds to eliminate any negative balance should that situation occur, and also authorize HRCU to transfer funds from any other HRCU account in which you have an interest, to create a non-negative balance in the HSA checking account.

If you do not correct a negative account balance immediately, The IRS will consider your account in a prohibited state and by law HRCU must close your account. According to the Internal Revenue Code, if an HSA account results in a negative balance, the HSA will cease to be an HSA on the first day of the year in which the prohibited transaction occurred, thus becoming taxable.

Access your funds or make your Visa® payment with our safe and secure remote banking services anywhere, anytime.

If you live, work, go to school in the State of New Hampshire or York County, Maine or have an immediate family member that is a current member, you are eligible to join HRCU.