March 12, 2024

HELOC vs. Home Equity: Which Option is Right for You?

Understanding the differences between HELOCs and Home Equity Loans can help you make an informed decision about which option is best suited to your needs.

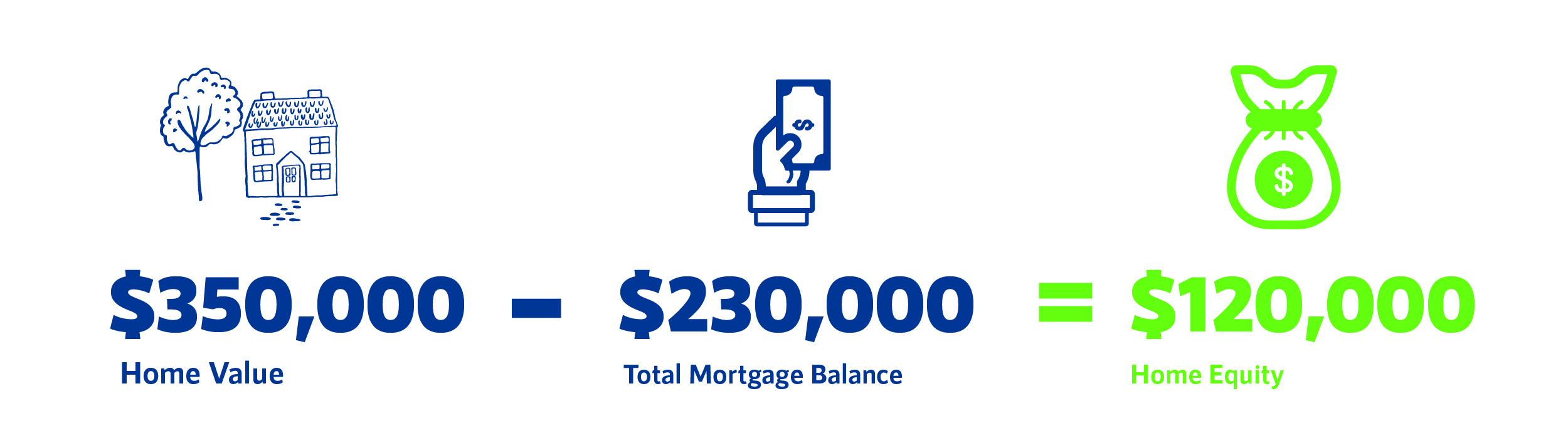

The Basics of Home Equity

Home equity refers to the portion of your home's value that you truly own, calculated by subtracting the outstanding mortgage balance from the current market value of the property. Essentially, it represents how much stake in your home that you don’t owe to your lender. Home equity grows over time as you make mortgage payments and as the value of your home appreciates.

Home equity serves as a valuable asset for homeowners. It can be tapped into through various financial products, such as home equity loans or lines of credit, for purposes like home improvements, debt consolidation, or other expenses. Building home equity is a key aspect of wealth accumulation for homeowners, providing potential financial flexibility and security.

HELOCs: Flexibility and Revolving Credit

A Home Equity Line of Credit (HELOC) is secured by the equity in your home and functions similarly to a credit card. You’re given a line of credit with a predetermined limit, and you can borrow against that limit as needed, typically over a set period, known as the draw period. During the draw period, you can borrow, repay, and borrow again, much like a revolving line of credit.

One of the key benefits of a HELOC is its flexibility. You have access to funds when you need them, and you only make payments on the outstanding balance of the line. Be sure to ask if your HELOC is an interest-only payment or a principal and interest payment to ensure you are making the correct financial decision for your needs.

After the draw period ends, the HELOC enters the repayment period, during which you can no longer borrow funds. The repayment period typically lasts for a set number of years, and the monthly payment amount will depend on the outstanding balance and the interest rate at the time the draw period ends.

It’s important to note that HELOCs are variable rate loans, meaning the interest rate on the loan can fluctuate depending on the status of the economy. This means your rate and payment can both increase and/or decrease on a month-by-month basis. People who utilize HELOCs should be prepared for these variations before opening the line of credit. However, most HELOCS have floors (where the rate cannot go lower than) and ceilings (where the rate cannot go higher than) to help protect you during times of economic uncertainty.

Home Equity Loans: Lump Sum and Fixed Payments

A Home Equity Loan, also known as a second mortgage, provides a lump sum of money upfront, which is repaid over time with fixed monthly payments. Unlike a HELOC, where you can borrow as needed, a Home Equity Loan is disbursed in a single lump sum, making it ideal for one-time expenses, such as home renovations or debt consolidation.

One of the primary advantages of a Home Equity Loan is the predictability of fixed monthly payments. With a fixed interest rate and a set repayment term, you'll know exactly how much you owe each month and when the loan will be paid off. This can be beneficial for budgeting purposes and for borrowers who prefer the stability of fixed payments.

However, because you receive the entire loan amount upfront, you'll start paying interest on the full balance immediately, regardless of whether you use all the funds right away. Additionally, unlike a HELOC, you can't borrow more money once the loan is disbursed unless you apply for a new loan.

Choosing the Right Option for You

When deciding between a HELOC and a Home Equity Loan, consider your financial needs, preferences, and long-term goals. If you anticipate needing access to funds over an extended period or for ongoing expenses, a HELOC’s flexibility may be more suitable. On the other hand, if you have a specific project or expense in mind and prefer the predictability of fixed payments, a Home Equity Loan may be the better choice.

Regardless of which option you choose, it's essential to carefully consider the terms, including interest rates, fees, and repayment terms, and to weigh the potential risks and benefits. Additionally, be sure to consult with a qualified financial advisor or mortgage lender to explore your options and determine the best solution for your unique situation. Our Mortgage Team at HRCU is always available to talk about your specific needs and advise you on the right home equity loan for you.

In conclusion, HELOCs and Home Equity Loans offer homeowners valuable opportunities to leverage their home equity for various financial needs. By understanding the differences between these two options and evaluating your specific circumstances, you can make an informed decision that aligns with your goals and financial objectives.

Membership

Membership Contact

Contact Rates

Rates Appointments

Appointments Locations

Locations